Virtual Call Center Software Market Synopsis:

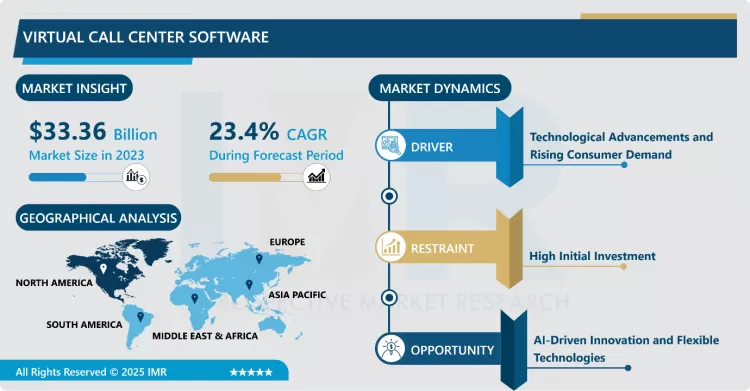

Virtual Call Center Software Market Size Was Valued at USD 33.36 Billion in 2023 and is Projected to Reach USD 221.34 Billion by 2032, Growing at a CAGR of 23.4% From 2024-2032.

Virtual call center software is a cloud-based communication tool that enables businesses to manage their customer service operations remotely. It typically includes features including call routing, IVR, and call recording, allowing businesses to provide high-quality support from anywhere.

Agents use cloud-based software to communicate with customers. The software typically includes features including call routing, IVR, call recording, analytics, and reporting capabilities. Despite the adoption of advanced communication technologies, call centers continue to be crucial to many businesses in recent times. This is especially true for companies that want to meet their customers at every possible contact point. Moreover, with over 70% of consumers contacting customer support by phone (CFI Group, 2020), the use of call center software is likely to remain strong in the coming years.

Virtual Call Center Software Market Growth and Trend Analysis:

- Market trends in call center software development continue to evolve in line with rising requirements for adaptability, efficiency, and superior customer interactions. Virtual and remote call centers represent a major trend due to the mark of a significant improvement in employee productivity while achieving higher satisfaction levels.

- Studies, such as one from Stanford, highlight that remote agents are more productive, with a reported 13% increase compared to in-office workers. The modified schedule enables businesses to access expertise beyond traditional limits by qualified candidates across multiple profiles including employees.

- Additionally, the cost savings associated with remote setups by reducing office space and commuting expenditures are substantial for both employers and employees. Employee retention rates are also higher in virtual environments, with agents staying on the job longer, thereby cutting down on turnover costs. In terms of customer service, remote agents equipped with advanced AI tools and integrated communication platforms can deliver quicker and more accurate responses, leading to improved customer satisfaction.

- The integration of AI-powered tools like chatbots and real-time assistance further enhances agent efficiency, allowing them to focus on complex issues while improving resolution times. UCaaS and CCaaS technologies have converged to create better service delivery by enabling enhanced collaboration which will lead to improved omnichannel customer interactions. The call center software market is undergoing a major transformation as developing technologies and work-from-home models continue to evolve.

Technological Advancements and Rising Consumer Demand

- The Results from rapid technological innovations shape the Virtual Call Center (VOC) Software market by improving its product efficiency and performance capabilities. Discoveries in automation combined with digitalization and material science technologies have resulted in advanced Virtual Call Center (VOC) Software solutions that suit various industrial needs. These technological advances promote both healthcare and automotive businesses and consumer electronics manufacturers to begin utilizing newer products.

- The growing awareness of Virtual Call Center (VOC) Software product benefits including enhanced quality alongside increased sustainability and reduced costs drives increased demand. High-income countries experience rapid growth in consumer demand because people favor products that are both premium quality and environmentally friendly.

High Initial Investment

- While Virtual Call Center (VOC) Software technologies offer long-term benefits, the high initial investment required for implementation can be a deterrent. Small and medium-sized enterprises often face financial constraints, limiting their ability to adopt such solutions. This cost barrier can slow market penetration, particularly in price-sensitive regions. Compliance with stringent government regulations and industry standards is a critical challenge for manufacturers in the Virtual Call Center (VOC) Software market. Differences in regional policies and the costs associated with meeting these regulations can restrain market growth.

AI-Driven Innovation and Flexible Technologies

- The prospects for virtual call center software head toward extensive innovative possibilities and sustained development potential. Virtual call center software must develop additional capabilities to match evolving customer expectations in the digital age and connect businesses to customers via new customer interaction methods. Virtual call center software now uses basic call routing to advanced AI-powered solutions which transformed both customer support interactions and operational business effectiveness.

- Future projections indicate that virtual call center solution markets will experience substantial growth because enterprises require flexible enabling technologies that allow seamless remote-client connections and premium customer support in digital workplace scenarios.

Virtual Call Center Software Market Segment Analysis:

Virtual Call Center Software Market is segmented based on type, application, and region

By Type, Cloud-Based segment is expected to dominate the market during the forecast period

- Cloud contact center software offers several advantages for businesses aiming to streamline their customer service operations. A cloud contact center provider, such as Talkdesk, offers key features like customer engagement, workforce engagement, analytics, and AI, along with flexible pricing options.

- One of the primary drivers is cost savings and scalability. Cloud-based solutions allow companies to avoid the high upfront costs associated with traditional on-premise systems. Instead, they can pay a predictable monthly subscription fee, which includes maintenance, updates, and support. This allows businesses to allocate their resources more efficiently and scale up or down as needed, without additional hardware or software investments.

By Application, the Cloud-Based segment held the largest share in 2023

- Cloud adoption in the financial services industry has seen significant growth, increasing from 37% in 2020 to 91% in 2023, with payment firms experiencing the highest rise from 32% in 2020 to 96% in 2023

- driven by the surge in digital payments during and after the pandemic. In 2023, regional adoption rates show North America leading at 98%, followed by APAC at 93%, and EMEA at 77%.

- Key use cases for cloud technology include customer-facing applications such as self-service portals, onboarding tools, and payment apps, while migration of core systems like compliance and risk management has been slower.

- However, firms face challenges, including data security concerns, high operational and transformation costs, and regulatory constraints. Despite these obstacles, the benefits of cloud adoption are clear, with improved operational productivity, product innovation, and customer satisfaction being the primary drivers to boost the segment growth.

- From the above graph, it is seen that the cloud adoption rates across key regions in the financial services industry as of 2023. North America leads with the highest adoption rate at 98%, representing its dominance in leveraging cloud technologies for financial services.

- EMEA (Europe, Middle East, and Africa) follows closely with a significant 93% adoption rate, reflecting its strong commitment to cloud-based innovations. APAC (Asia-Pacific), while slightly lagging, still reports a robust 77% adoption, highlighting growing investments in cloud transformation across the region.

Virtual Call Center Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The United States Virtual Call Center (VOC) Software market indicated booming growth due to its advanced infrastructure, technological innovation, and high consumer demand. Top Key players in the market are expanded digitalization and sustainable practices to maintain competitive edges. Favorable government policies and significant investments in research and development contribute to its strong position globally.

- For instance, In June 2023, JustCall by SaaSLabs, a contact center software provider backed by Sequoia Capital, launched JustCall iQ, an AI-driven conversational intelligence platform for small and medium-sized businesses (SMBs). The solution is designed to enhance the performance of call center sales teams, operations, and customer support. Subsequently, the Virtual Call Center (VOC) Software market is poised to remain a significant contributor to both the domestic economy and the global market landscape in the forecast period.

Virtual Call Center Software Market Active Players:

- 8x8 Inc. (USA)

- Avaya (USA)

- Aircall (France)

- Amazon Connect (USA)

- Aspect Software (USA)

- Avoxi (USA)

- Cisco Systems (USA)

- CloudTalk (Slovakia)

- Dialpad (USA)

- Five9 (USA)

- Freshdesk (Freshworks) (India)

- Genesys (USA)

- Mitel (ShoreTel) (Canada)

- NICE inContact (Israel)

- RingCentral (USA)

- Talkdesk (USA)

- TTEC (USA)

- Twilio (USA)

- Verint Systems (USA)

- Voxbone (Belgium)

- Zendesk (USA)

- Other Active Players

Key Industry Developments in the Virtual Call Center Software Market:

- In September 2024, Avaya launched the Avaya Experience Platform (AXP) Public Cloud in India. It has become available nationwide. The launch of AXP Public Cloud in India completes the local availability of Avaya's unified CX platform this will make it convenient for Indian organizations spanning public services, healthcare, BFSI, telecoms, and business process outsourcing to select from AXP Public Cloud, AXP Private Cloud, and AXP On-Prem.

- In April 2023, Teckinfo Solutions Pvt. Ltd., a leading software product company launched its latest offering, ID Cloud - Premium Contact Centre Software platform. With this latest release, ID Cloud, the company seeks to provide a comprehensive customer engagement platform that simplifies and streamlines customer engagement for businesses of all magnitudes.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Virtual Call Cener Software Market by Type

4.1 Virtual Call Cener Software Market Snapshot and Growth Engine

4.2 Virtual Call Cener Software Market Overview

4.3 Cloud-Based & VoIP

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cloud-Based & VoIP: Geographic Segmentation Analysis

Chapter 5: Virtual Call Cener Software Market by Application

5.1 Virtual Call Cener Software Market Snapshot and Growth Engine

5.2 Virtual Call Cener Software Market Overview

5.3 BFSI

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 BFSI: Geographic Segmentation Analysis

5.4 Consumer Goods & Retail

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Consumer Goods & Retail: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Virtual Call Cener Software Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 8X8 INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AIRCALL (FRANCE)

6.4 AMAZON CONNECT (AWS) (USA)

6.5 ASPECT SOFTWARE (USA)

6.6 AVOXI (USA)

6.7 CISCO SYSTEMS (USA)

6.8 CLOUDTALK (SLOVAKIA)

6.9 DIALPAD (USA)

6.10 FIVE9 (USA)

6.11 FRESHDESK (FRESHWORKS) (INDIA)

6.12 GENESYS (USA)

6.13 MITEL (SHORETEL) (CANADA)

6.14 NICE INCONTACT (ISRAEL)

6.15 RINGCENTRAL (USA)

6.16 TALKDESK (USA)

6.17 TTEC (USA)

6.18 TWILIO (USA)

6.19 VERINT SYSTEMS (USA)

6.20 VOXBONE (BELGIUM)

6.21 ZENDESK (USA)

6.22 OTHER ACTIVE PLAYERS.

Chapter 7: Global Virtual Call Cener Software Market By Region

7.1 Overview

7.2 . North America Virtual Call Cener Software Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Cloud-Based & VoIP

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 BFSI

7.2.5.2 Consumer Goods & Retail

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3 . Eastern Europe Virtual Call Cener Software Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Cloud-Based & VoIP

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 BFSI

7.3.5.2 Consumer Goods & Retail

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4 . Western Europe Virtual Call Cener Software Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Cloud-Based & VoIP

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 BFSI

7.4.5.2 Consumer Goods & Retail

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5 . Asia Pacific Virtual Call Cener Software Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Cloud-Based & VoIP

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 BFSI

7.5.5.2 Consumer Goods & Retail

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6 . Middle East & Africa Virtual Call Cener Software Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Cloud-Based & VoIP

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 BFSI

7.6.5.2 Consumer Goods & Retail

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7 . South America Virtual Call Cener Software Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Cloud-Based & VoIP

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 BFSI

7.7.5.2 Consumer Goods & Retail

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Virtual Call Center Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 33.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

23.4 % |

Market Size in 2032: |

USD 221.34 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Virtual Call Center Software Market research report is 2024-2032.

8x8 Inc. (USA), Aircall (France), Amazon Connect (AWS) (USA), Aspect Software (USA), Avoxi (USA), Cisco Systems (USA), CloudTalk (Slovakia), Dialpad (USA), Five9 (USA), Freshdesk (Freshworks) (India), Genesys (USA), Mitel (ShoreTel) (Canada), NICE inContact (Israel), RingCentral (USA), Talkdesk (USA), TTEC (USA), Twilio (USA), Verint Systems (USA), Voxbone (Belgium), Zendesk (USA), and Other Active Players.

The Virtual Call Center Software Market is segmented into Type, Nature, Application, and Region. By Type, it is categorized into Cloud-Based and VoIP, By Application it is categorized into BFSI, Consumer Goods, and Retail. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Virtual call center software is a cloud-based communication tool that enables businesses to manage their customer service operations remotely. It typically includes features including call routing, IVR, and call recording, allowing businesses to provide high-quality support from anywhere.

Virtual Call Center Software Market Size Was Valued at USD 33.36 Billion in 2023 and is Projected to Reach USD 221.34 Billion by 2032, Growing at a CAGR of 23.4% From 2024-2032.