Solid State Decoupler Market Synopsis

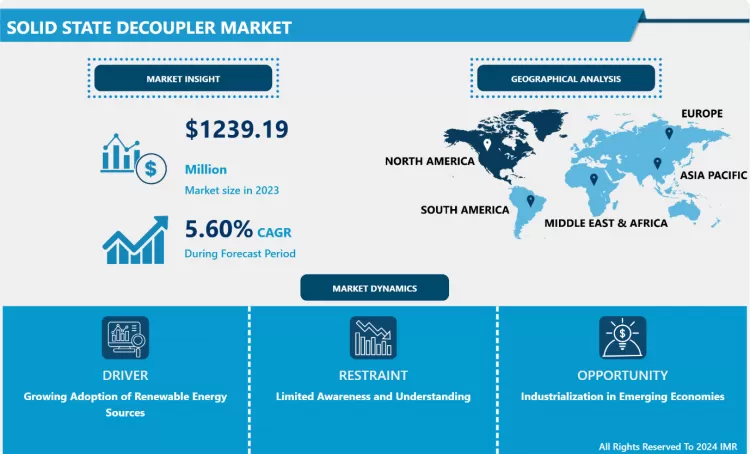

Solid State Decoupler Market Size Was Valued at USD 1239.19 Million in 2023, and is Projected to Reach USD 2023.55 Million by 2032, Growing at a CAGR of 5.60% From 2024-2032.

A Solid State Decoupler (SSD) is an electronic device that provides electrical isolation while allowing cathodic protection currents to flow in pipelines or structures. It prevents fault currents, AC interference, or lightning surges from damaging systems, ensuring safety and maintaining pipeline integrity without compromising corrosion protection.

- The Solid State Decoupler (SSD) is a crucial device in buried pipeline and storage tank systems, serving as a DC voltage level clamp while simultaneously mitigating AC voltage. Composed of semiconductor electronics and a large capacitor, SSDs operate by blocking DC under normal conditions and activating during over-voltage events to protect systems under Cathodic Protection. The device permits up to 15A of AC current while preventing DC flow until a predetermined threshold is exceeded, at which point it forms a short circuit to limit voltage. The SSD market is poised for growth driven by rising needs for corrosion protection across industries, increasing renewable energy adoption, and stringent regulatory requirements for safety and environmental protection. SSDs enhance grounding system safety and reliability, making them vital in sectors like oil and gas, while also supporting the shift to renewable energy sources

- Solid-state decouplers (SSDs) Market is anticipated to grow due to rising demand for corrosion prevention, renewable energy integration, and adherence to environmental regulations. SSDs are valued for their ability to minimize electrical interference, combat corrosion, and enhance system stability, making them essential across various industries. Their advantages over passive decoupling methods—such as compact size, high efficiency, and fast response times—align with the increasing focus on energy efficiency and reliability in consumer electronics, automotive electronics, and industrial automation. Furthermore, SSDs are vital for effective grounding in renewable energy systems, ensuring stable electrical environments and reducing failure risks, thus supporting the overall growth of the SSD market.

- Global consumption of renewable energy has increased significantly over the last two decades. Consumption levels nearly reached 45.18 exajoules in 2022. Despite its rapid growth, renewable energy consumption remains far below that of coal, natural gas, oil, and other energy technologies.

- Around half of global renewable energy consumption comes from modern bioenergy, though solar photovoltaics has led recent capacity growth. Advances in technology and decreased costs fuel this expansion. Governments need supportive policies for renewable energy. The Solid State Decoupler Market enhances energy storage, facilitating better renewable grid integration.

Solid State Decoupler Market Trend Analysis

The Increasing Adoption of Electronic Devices

- The Solid State Decoupler (SSD) plays a crucial role by isolating parts of an electrical circuit, preventing noise or interference from affecting sensitive components. This is vital in multi-component systems with varying voltages or frequencies, ensuring stable and reliable operation. SSDs play a vital role in various industries like automotive and telecommunications, ensuring data transfer integrity and signal quality in complex systems. They are key to the effective operation of electronic networks in devices such as smartphones, PCs, and advanced medical equipment. Additionally, SSDs support power supply units (PSUs) by providing a clean and stable power supply, reducing noise and voltage fluctuations, which is crucial for preventing data loss and system failures in high-performance computers.

- The increasing use of electronic devices across different applications necessitates the widespread implementation of Solid State Decouplers to ensure optimal efficiency, reliability, and compatibility. These flexible components serve as guardians of signal integrity, preventing noise and interference from disrupting the functionality of sensitive electronic systems. As technology advances and electronic devices become increasingly ubiquitous, SSDs will remain essential for the seamless functioning of modern gadgets.

Enhanced Protection for Buried Structures

- The increasing use of electronic devices across different applications requires the widespread implementation of Solid State Decouplers to ensure optimal efficiency, reliability, and compatibility. These flexible components serve to safeguard signal integrity, preventing noise and interference from disrupting the functioning of sensitive electronic systems. As technology advances and electronic devices become increasingly common, SSDs will remain essential for the seamless functioning of modern gadgets.

- Decouplers cut off electrical current in metallic elements, isolating underground structures and preventing oxidation from stray currents. This reduces the need for sacrificial anodes and corrosion protection methods, extending infrastructure lifespan while lowering maintenance costs and time for expansions and repairs. Solid-state decouplers offer a versatile solution for various environments, including high-salinity coastal and urban areas. Their compact size ensures easy installation, making them cost-effective for both new constructions and retrofits, while reliably protecting important underground infrastructure. The solid-state decoupler industry offers a reliable, cost-effective solution for subterranean building protection by preventing stray electrical currents, thus reducing corrosion and preserving expensive infrastructure integrity.

Solid State Decoupler Market Segment Analysis:

Solid State Decoupler Market is segmented on the basis of Type, Application, and Region

By Application, Buried Pipeline segment is expected to dominate the market during the forecast period

- The Buried Pipeline segment is projected to dominate the Solid State Decoupler (SSD) Market during the forecast period. Buried pipes alongside high-voltage power lines require Solid State Decouplers (SSDs) to ensure integrity and safety. These pipes are susceptible to induced AC currents, leading to safety risks and corrosion issues. SSDs act as clamping devices to mitigate these dangers, isolating the cathodic protection system. They are utilized with copper or zinc mitigation wires, allowing induced AC to be safely grounded, protecting the pipeline from damage.

- Solid state decouplers (SSDs) are crucial for protecting buried pipelines from electrical faults, lightning, and AC interference while maintaining cathodic protection. Their growing popularity stems from their durability, low maintenance, and capability to function in extreme conditions. Increased investments in energy infrastructure and regulations for corrosion protection enhance market growth. Oil and gas companies are integrating SSDs to improve pipeline longevity and minimize risks. Technological advancements, like enhanced voltage thresholds and compact designs, will further boost SSD adoption in the market.

By Type, DC Solid-State Decoupler segment held the largest share of 52.41% in 2023

- The DC Solid-State Decoupler segment held the largest share in the Solid State Decoupler Market. A key element of cathodic protection (CP) systems is the DC Solid State Decoupler, especially in situations where CP potentials are insufficient due to grounding connections. This device acts as a barrier, preventing CP current from entering grounding systems and effectively protecting the cathodically protected structure. It operates as a high-power solid-state electronic switch, maintaining DC disconnection between the grounding system and the protected structure. After an overvoltage incident, the Decoupler automatically returns to its initial condition, offering an effective CP design solution that protects critical infrastructure against corrosion and electrical hazards.

- The Solid State Decoupler (SSD) is critical for buried pipeline and storage tank systems, allowing DC voltage clamping while minimizing AC voltage. It can let through up to 15A of induced AC but blocks DC below a predetermined threshold. If DC voltage exceeds this limit, the SSD triggers a near-short circuit to limit the voltage and deactivates once the surge subsides. Technological advancements in semiconductors improve performance, while modular switching cells (MSCs) with wide-bandgap materials manage current imbalances for consistent operation in high-capacity applications.

Solid State Decoupler Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North America is Expected to Dominate the Market Over the Forecast period the solid state decoupler market in North America is experiencing significant growth driven by increasing demand for advanced electronic devices in sectors such as telecommunications, automotive, consumer electronics and industrial automation. The growth of the Solid State Decoupler Market is driven by expanding infrastructure in North America. Increased urbanization and industrial activities boost the need for durable infrastructure, particularly underground pipelines that transport fluids like oil and water.

- These pipelines, often made of different metals, risk galvanic corrosion. Solid State Decouplers effectively prevent this by electrically isolating dissimilar metals. Stringent regulations for infrastructure protection have increased the adoption of Solid State Decouplers. Strict guidelines ensure the safety of underground pipelines and metallic structures, necessitating corrosion prevention measures and driving demand for innovative solutions like Solid State Decouplers. Moreover, advancements in materials science and engineering have contributed to the proliferation of Solid State Decouplers in the market. Manufacturers are continuously investing in research and development to enhance the performance and durability of these decoupling devices.

Solid State Decoupler Market Top Key Players:

- AMAC Corrosion (Australia)

- Cathtect Engineering (South Africa)

- Cathtect USA (United States)

- CGL Engineering Co., Ltd. (Thailand)

- Dairyland Electrical Industries (United States)

- Dehn SE (Germany)

- Interprovincial Corrosion Control Company Ltd. (Canada)

- Jennings Anodes (United States)

- Karatec Resources SDN BHD (Malaysia)

- Stuart Steel Protection (United States)

- Tianjin Furuide Environment Engineering Co., Ltd. (China)

- Topcorr Corrosion Technology (China), and Other Active Players

Key Industry Developments in the Solid State Decoupler Market:

- In November 2023, Stuart Steel Protection expanded with the acquisition of Northwestern Cathodic. Stuart Steel Protection (SSP) has agreed to buy the assets of Northwestern Cathodic (NWCAT), a Colorado-based energy manufacturing supplier, in a move that will quadruple the company’s personnel and geographic reach. NWCAT specializes in cathodic protection materials and services for utilities, propane, onshore oilfield production equipment, vessels, and tanks, with offices in Grand Junction, CO, and Greenville, SC.

- In January 2023, Integrated Utility Services (IUS) acquired Stuart Steel Protection Corporation's assets. The acquisition makes IUS one of the largest minority-owned energy manufacturing and services companies of its sort in the US. Integrated Utility Services (IUS) of Houston has purchased the assets of Stuart Steel Protection Corporation (SSPC), a corrosion control product manufacturer, packager, and master distributor based in New Jersey. IUS, a National Minority Supplier Development Council-certified Minority Business Enterprise ("MBE"), will operate these assets through its newly formed Stuart Steel Protection, LLC.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Solid State Decoupler Market by Type

4.1 Solid State Decoupler Market Snapshot and Growth Engine

4.2 Solid State Decoupler Market Overview

4.3 AC Solid State Decoupler

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 AC Solid State Decoupler: Geographic Segmentation Analysis

4.4 DC Solid State Decoupler

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 DC Solid State Decoupler: Geographic Segmentation Analysis

Chapter 5: Solid State Decoupler Market by Application

5.1 Solid State Decoupler Market Snapshot and Growth Engine

5.2 Solid State Decoupler Market Overview

5.3 Buried Pipeline

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Buried Pipeline: Geographic Segmentation Analysis

5.4 Tank System

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Tank System: Geographic Segmentation Analysis

5.5 Marine Structures

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Marine Structures: Geographic Segmentation Analysis

5.6 Electrical Grounding Systems

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Electrical Grounding Systems: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Solid State Decoupler Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AMAC CORROSION (AUSTRALIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CATHTECT ENGINEERING (SOUTH AFRICA)

6.4 CATHTECT USA (UNITED STATES)

6.5 CGL ENGINEERING CO LTD (THAILAND)

6.6 DAIRYLAND ELECTRICAL INDUSTRIES (UNITED STATES)

6.7 DEHN SE (GERMANY)

6.8 INTERPROVINCIAL CORROSION CONTROL COMPANY LTD (CANADA)

6.9 JENNINGS ANODES (UNITED STATES)

6.10 KARATEC RESOURCES SDN BHD (MALAYSIA)

6.11 STUART STEEL PROTECTION (UNITED STATES)

6.12 TIANJIN FURUIDE ENVIRONMENT ENGINEERING CO LTD (CHINA)

6.13 TOPCORR CORROSION TECHNOLOGY (CHINA)

6.14 OTHER ACTIVE PLAYERS

Chapter 7: Global Solid State Decoupler Market By Region

7.1 Overview

7.2 . North America Solid State Decoupler Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 AC Solid State Decoupler

7.2.4.2 DC Solid State Decoupler

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Buried Pipeline

7.2.5.2 Tank System

7.2.5.3 Marine Structures

7.2.5.4 Electrical Grounding Systems

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 U.S.

7.2.6.2 Canada

7.2.6.3 Mexico

7.3 . Europe Solid State Decoupler Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 AC Solid State Decoupler

7.3.4.2 DC Solid State Decoupler

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Buried Pipeline

7.3.5.2 Tank System

7.3.5.3 Marine Structures

7.3.5.4 Electrical Grounding Systems

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Germany

7.3.6.2 U.K.

7.3.6.3 France

7.3.6.4 Italy

7.3.6.5 Russia

7.3.6.6 Spain

7.4 . Asia-Pacific Solid State Decoupler Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 AC Solid State Decoupler

7.4.4.2 DC Solid State Decoupler

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Buried Pipeline

7.4.5.2 Tank System

7.4.5.3 Marine Structures

7.4.5.4 Electrical Grounding Systems

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 China

7.4.6.2 India

7.4.6.3 Japan

7.4.6.4 Southeast Asia

7.5 . South America Solid State Decoupler Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 AC Solid State Decoupler

7.5.4.2 DC Solid State Decoupler

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Buried Pipeline

7.5.5.2 Tank System

7.5.5.3 Marine Structures

7.5.5.4 Electrical Grounding Systems

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 Brazil

7.5.6.2 Argentina

7.6 . Middle East & Africa Solid State Decoupler Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 AC Solid State Decoupler

7.6.4.2 DC Solid State Decoupler

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Buried Pipeline

7.6.5.2 Tank System

7.6.5.3 Marine Structures

7.6.5.4 Electrical Grounding Systems

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Saudi Arabia

7.6.6.2 South Africa

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Solid State Decoupler Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1239.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.60% |

Market Size in 2032: |

USD 2023.55 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Solid State Decoupler Market research report is 2024-2032.

AMAC Corrosion (Australia), Cathtect Engineering (South Africa), Cathtect USA (United States), CGL Engineering Co., Ltd. (Thailand), Dairyland Electrical Industries (United States), Dehn SE (Germany), Interprovincial Corrosion Control Company Ltd. (Canada), Jennings Anodes (United States), Karatec Resources SDN BHD (Malaysia), Stuart Steel Protection (United States), Tianjin Furuide Environment Engineering Co., Ltd. (China), Topcorr Corrosion Technology (China), and Other Active Players.

The Solid State Decoupler Market is segmented into Type, Application, and Region. By Type, the market is categorized into Solid State Decoupler and DC Solid State Decoupler. By Application, the market is categorized into Buried Pipeline, Tank System, Marine Structures, and Electrical Grounding Systems. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.

A Solid State Decoupler (SSD) is an electronic device that provides electrical isolation while allowing cathodic protection currents to flow in pipelines or structures. It prevents fault currents, AC interference, or lightning surges from damaging systems, ensuring safety and maintaining pipeline integrity without compromising corrosion protection.

Solid State Decoupler Market Size Was Valued at USD 1239.19 Million in 2023, and is Projected to Reach USD 2023.55 Million by 2032, Growing at a CAGR of 5.60% From 2024-2032.