Foot and Mouth Disease Vaccine Market Synopsis:

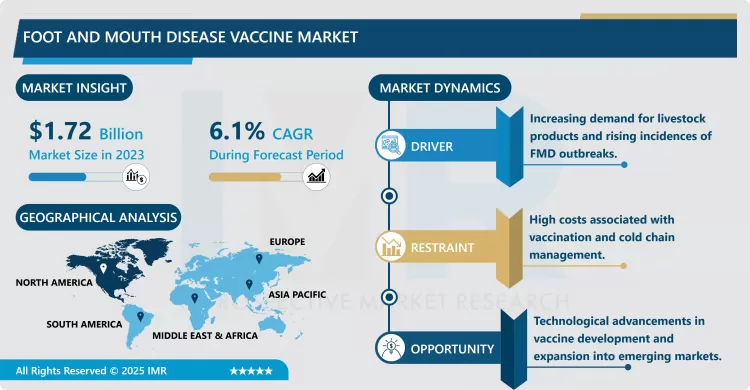

Foot and Mouth Disease Vaccine Market Size Was Valued at USD 1.72 Billion in 2023, and is Projected to Reach USD 2.92 Billion by 2032, Growing at a CAGR of 6.1% From 2024-2032.

The Foot and Mouth Disease (FMD) Vaccine Market refers to the business that revolves around the development, supply, and marketing of vaccines against FMD – a viral illness infectious to cattle, pigs, sheep, goats, and deer amongst other cloven-hoofed animals. This disease remains a major economic burden since it slightly affects animals’ productivity and trade in the livestock industries. This market is strategically significant for the global veterinary vaccine market since it is an important weapon against diseases in the regions where FMD is present and enzootic.

The Foot and Mouth Disease Vaccine Market was a growing market and has been thriving worldwide due to the increasing necessities of healthy animal products, increased demand for livestock, and the necessity to reduce the loss in livestock production due to FMD . The market is categorized by the traditional and advanced types of vaccines such as inactivated and live attenuated flu vaccines, plus the use of newer technologies in recombinant vaccines. The cuisines which have a large number of live stocks and where the FMD is more common in developing countries in Asia, Africa and Latin America are the primary markets for these vaccines.

The market is also driven by the high governmental standards of sanitation and other measures necessary to fight diseases; the result is that increasing numbers of people opt for vaccination. Also, the COVID-19 pandemic has been growing global spending on veterinary care, and organizations such as the World Organisation for Animal Health (OIE) and regional governments’ bodies are funding and partnering in vaccination campaigns, which will drive the market. However, factors such as cold chain in storing vaccines, higher costs involved and restricted accessibility in some regions poses an issue for market development.

Foot and Mouth Disease Vaccine Market Trend Analysis:

Growing Demand for Recombinant Vaccines

- The disease dynamics that are driving the Foot and Mouth Disease Vaccine Market include new trends such as the use of recombinant vaccines in comparison with traditional vaccines in terms of safety, stability and efficacy. This type of vaccines is genetically engineered hence comes with little or no side effects while offering the body a long-term immunity. As risks associated with vaccines increase regardless of the fact that with the development of recombinant technology, safe vaccines are likely to surface in the market especially in the developed nations where safety norms are high, the markets for the recombinant vaccines are anticipated to expand. Moreover, the growing research and development outlay on biotechnological innovations to bring about this transition towards better and superior vaccines represent fresh product development opportunities.

Expansion in Emerging Markets

- Another emerging challenge for the FMD Vaccine Market can be translated into the increased focus on the development of business across the emerging markets of India, China, Brazil, and some African countries with a concentration on expanding vaccination programs. These regions have high volumes of susceptible livestock to FMD outbreaks, and which the case results in significant economic losses. Increasing awareness about FMD vaccination and government supported programmes for animal health and productivity provides the vaccine manufactures a good chance for growth. In addition, increased investment in the improvement of veterinary structures from global organizations in these areas contributes to market development opportunities.

Foot and Mouth Disease Vaccine Market Segment Analysis:

Foot and Mouth Disease Vaccine Market is Segmented on the basis of type, animal type, distribution channel, and region

By Type, Conventional Vaccine segment is expected to dominate the market during the forecast period

- The Conventional Vaccine segment holds the largest market share in the Foot and Mouth Disease (FMD) Vaccine Market in the coming years due to the higher use in areas which are highly affected by FMD. These vaccines include inactivated vaccines and live attenuated vaccines and have shown great efficacy for decades, and are relatively cheaper than the recently developed vaccines. Such vaccines are highly preferred in developing nations that always seek ways and means to economically fight FMD. Furthermore, the high level of support from governments and the international organization to mass vaccination using the conventional vaccines also increases the market share for the vaccines. While recombinant vaccines are gaining prominence, the global sales, efficacy and cost effectiveness and large-scale delivery capability of traditional vaccines keep them in vogue in FMD vaccine market.

By Animal type, Cattle segment expected to held the largest share

- Of these latest insights, the Cattle segment likely to dominate the overall Foot and Mouth Disease (FMD) Vaccine Market during the forecast period, as cattle play a paramount role in the global livestock industry. FMD affects cattle most severely, and afflictions are likely to result in massive losses in meat and dairy supplies, trade embargoes and compulsory slaughtering of affected livestock. Therefore, the emphasis is made on the immunization of cattle, including the orientation in priority regions for livestock production, for example, Asia-Pacific and Latin America & liquate higher demand &help; for beef and dairy and programs that promote health and disease control trigger the cattle vaccinations; Secondly, cattle farming is less fragmented than other segments thus making easier to adopt measures such as massive vaccination which in turn buttresses the dominance of this segment.

Foot and Mouth Disease Vaccine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific held the largest revenue share of 48.2% in 2023 due to high incidence rates of FMD and an increasing amount of cattle population. Market development that has been driven by government financing and investment, especially the development of the healthcare industry, has supported the future projection across the forecasted period. Another factor is the fact that, today’s cattle owners are more informed than in the past. New down detailed, the governments of Asia-Pacific countries have participated in raising the awareness of the importance of eradicating as well as controlling FMD.

Active Key Players in the Foot and Mouth Disease Vaccine Market:

- Agrovet Market Animal Health (Peru)

- Bayer Healthcare (Germany)

- Biogénesis Bagó (Argentina)

- Boehringer Ingelheim (Germany)

- Brilliant Bio Pharma (India)

- Cavet Bio (China)

- Ceva Santé Animale (France)

- Indian Immunologicals Ltd (India)

- Inovio Pharmaceuticals (United States)

- MediMark (Netherlands)

- Merial (France)

- MSD Animal Health (United States)

- Romvac (Romania)

- Vetal Animal Health Products (Turkey)

- Zoetis (United States)

- Other Active Players

Key Industry Developments in the Foot and Mouth Disease Vaccine Market:

- In July 2024, Biogénesis Bagó established a vaccine manufacturing facility in Brazil that can produce more than 10 million doses of live attenuated virus vaccines for FMD annually.

- In March 2023, With the FMD SAT-2 vaccination, the European Commission helped Turkey improve the region's animal health status.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Foot and Mouth Disease Vaccine Market by Type

4.1 Foot and Mouth Disease Vaccine Market Snapshot and Growth Engine

4.2 Foot and Mouth Disease Vaccine Market Overview

4.3 Conventional Vaccine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Conventional Vaccine: Geographic Segmentation Analysis

4.4 Aluminium Hydroxide based vaccine

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Aluminium Hydroxide based vaccine: Geographic Segmentation Analysis

4.5 Oil based vaccines

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Oil based vaccines: Geographic Segmentation Analysis

4.6 Emergency Vaccines

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Emergency Vaccines: Geographic Segmentation Analysis

Chapter 5: Foot and Mouth Disease Vaccine Market by Animal Type

5.1 Foot and Mouth Disease Vaccine Market Snapshot and Growth Engine

5.2 Foot and Mouth Disease Vaccine Market Overview

5.3 Cattle

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cattle: Geographic Segmentation Analysis

5.4 Sheep

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Sheep: Geographic Segmentation Analysis

5.5 and Goat

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Goat: Geographic Segmentation Analysis

5.6 Swine

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Swine: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Foot and Mouth Disease Vaccine Market by Distribution Channel

6.1 Foot and Mouth Disease Vaccine Market Snapshot and Growth Engine

6.2 Foot and Mouth Disease Vaccine Market Overview

6.3 Veterinary Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Veterinary Clinics: Geographic Segmentation Analysis

6.4 Government Institutions

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Government Institutions: Geographic Segmentation Analysis

6.5 Other

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Other: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Foot and Mouth Disease Vaccine Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AGROVET MARKET ANIMAL HEALTH (PERU)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BAYER HEALTHCARE (GERMANY)

7.4 BIOGÉNESIS BAGÓ (ARGENTINA)

7.5 BOEHRINGER INGELHEIM (GERMANY)

7.6 BRILLIANT BIO PHARMA (INDIA)

7.7 CAVET BIO (CHINA)

7.8 CEVA SANTÉ ANIMALE (FRANCE)

7.9 INDIAN IMMUNOLOGICALS LTD (INDIA)

7.10 INOVIO PHARMACEUTICALS (UNITED STATES)

7.11 MEDIMARK (NETHERLANDS)

7.12 MERIAL (FRANCE)

7.13 MSD ANIMAL HEALTH (UNITED STATES)

7.14 ROMVAC (ROMANIA)

7.15 VETAL ANIMAL HEALTH PRODUCTS (TURKEY)

7.16 ZOETIS (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Foot and Mouth Disease Vaccine Market By Region

8.1 Overview

8.2 . North America Foot and Mouth Disease Vaccine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Conventional Vaccine

8.2.4.2 Aluminium Hydroxide based vaccine

8.2.4.3 Oil based vaccines

8.2.4.4 Emergency Vaccines

8.2.5 Historic and Forecasted Market Size By Animal Type

8.2.5.1 Cattle

8.2.5.2 Sheep

8.2.5.3 and Goat

8.2.5.4 Swine

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Veterinary Clinics

8.2.6.2 Government Institutions

8.2.6.3 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3 . Eastern Europe Foot and Mouth Disease Vaccine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Conventional Vaccine

8.3.4.2 Aluminium Hydroxide based vaccine

8.3.4.3 Oil based vaccines

8.3.4.4 Emergency Vaccines

8.3.5 Historic and Forecasted Market Size By Animal Type

8.3.5.1 Cattle

8.3.5.2 Sheep

8.3.5.3 and Goat

8.3.5.4 Swine

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Veterinary Clinics

8.3.6.2 Government Institutions

8.3.6.3 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4 . Western Europe Foot and Mouth Disease Vaccine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Conventional Vaccine

8.4.4.2 Aluminium Hydroxide based vaccine

8.4.4.3 Oil based vaccines

8.4.4.4 Emergency Vaccines

8.4.5 Historic and Forecasted Market Size By Animal Type

8.4.5.1 Cattle

8.4.5.2 Sheep

8.4.5.3 and Goat

8.4.5.4 Swine

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Veterinary Clinics

8.4.6.2 Government Institutions

8.4.6.3 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5 . Asia Pacific Foot and Mouth Disease Vaccine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Conventional Vaccine

8.5.4.2 Aluminium Hydroxide based vaccine

8.5.4.3 Oil based vaccines

8.5.4.4 Emergency Vaccines

8.5.5 Historic and Forecasted Market Size By Animal Type

8.5.5.1 Cattle

8.5.5.2 Sheep

8.5.5.3 and Goat

8.5.5.4 Swine

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Veterinary Clinics

8.5.6.2 Government Institutions

8.5.6.3 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6 . Middle East & Africa Foot and Mouth Disease Vaccine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Conventional Vaccine

8.6.4.2 Aluminium Hydroxide based vaccine

8.6.4.3 Oil based vaccines

8.6.4.4 Emergency Vaccines

8.6.5 Historic and Forecasted Market Size By Animal Type

8.6.5.1 Cattle

8.6.5.2 Sheep

8.6.5.3 and Goat

8.6.5.4 Swine

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Veterinary Clinics

8.6.6.2 Government Institutions

8.6.6.3 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7 . South America Foot and Mouth Disease Vaccine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Conventional Vaccine

8.7.4.2 Aluminium Hydroxide based vaccine

8.7.4.3 Oil based vaccines

8.7.4.4 Emergency Vaccines

8.7.5 Historic and Forecasted Market Size By Animal Type

8.7.5.1 Cattle

8.7.5.2 Sheep

8.7.5.3 and Goat

8.7.5.4 Swine

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Veterinary Clinics

8.7.6.2 Government Institutions

8.7.6.3 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Foot and Mouth Disease Vaccine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.72 Billion |

|

Forecast Period 2024-32 CAGR: |

6.1% |

Market Size in 2032: |

USD 2.92 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Animal Type |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Foot and Mouth Disease Vaccine Market research report is 2024-2032.

Agrovet Market Animal Health (Peru), Bayer Healthcare (Germany), Biogénesis Bagó (Argentina), Boehringer Ingelheim (Germany), Brilliant Bio Pharma (India), Cavet Bio (China), Ceva Santé Animale (France), Indian Immunologicals Ltd (India), Inovio Pharmaceuticals (United States), MediMark (Netherlands), Merial (France), MSD Animal Health (United States), Romvac (Romania), Vetal Animal Health Products (Turkey), Zoetis (United States), and Other Active Players.

The Foot and Mouth Disease Vaccine Market is segmented into Type, Animal Type, Distribution Channel and region. By Type, the market is categorized into Conventional Vaccine, Aluminium Hydroxide based vaccine, Oil based vaccines, Emergency Vaccines. By Animal Type, the market is categorized into Cattle, Sheep, and Goat, Swine, Others. By Distribution Channel, the market is categorized into Veterinary Clinics, Government Institutions, Other. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Foot and Mouth Disease (FMD) Vaccine Market refers to the business that revolves around the development, supply, and marketing of vaccines against FMD – a viral illness infectious to cattle, pigs, sheep, goats, and deer amongst other cloven-hoofed animals. This disease remains a major economic burden since it slightly affects animals’ productivity and trade in the livestock industries. This market is strategically significant for the global veterinary vaccine market since it is an important weapon against diseases in the regions where FMD is present and enzootic.

Foot and Mouth Disease Vaccine Market Size Was Valued at USD 1.72 Billion in 2023, and is Projected to Reach USD 2.92 Billion by 2032, Growing at a CAGR of 6.1% From 2024-2032.