Empty IV Bags Market Synopsis:

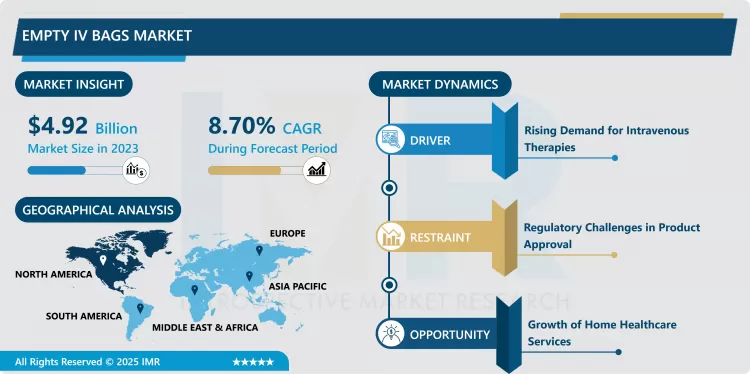

Empty IV Bags Market Size Was Valued at USD 4.92 Billion in 2023, and is Projected to Reach USD 10.42 Billion by 2032, Growing at a CAGR of 8.70% From 2024-2032.

The empty iv bags is a segment of the health care that manufactures and sells IV bags which do not contain any contents and can be used for delivering fluids, food and medications to the patients. They are avails in a variety of materials, and dimensions and arrangement to suit the different medical requirements for hospitals, clinics and home care facilities. In addition, increasing pressure on healthcare systems to deliver affordable and effective care, along with the innovation of new health care product solutions, also act as an opportunity for this market. y content, primarily used for administering fluids, medications, and nutrients to patients. These bags come in various materials, sizes, and configurations, catering to diverse medical needs across hospitals, clinics, and home healthcare settings. The rising demand for efficient patient care and advancements in medical technology are key factors driving the growth of this market.

The factors for the rapid expansion of the empty IV bags market are the rising incidence of chronic diseases and the ageing population of the global population. Currently there is a jobs advancement of Intravenous (IV) bags due to such diseases as diabetes, cancer, cardiovascular diseases since they are drawn out conditions that would need long term injections. Also, an increase in surgical operations and hospitalization fuels the growth of the market, since patients need fluid management during treatment.

Technological advancements of IV bag manufacture, and these are also key factors driving the market. Examples include the production of polymer IV bags other than PVC including Environmentally sensitive Materials IV bags for the same have received market approval due to the reduced risk of releasing phthalates. In addition, adherence to stringent patient safety measures and infection control measures has paved way for adoption of enhanced safer and more effective IV delivery systems that has created higher market for empty IV bags.

Empty IV Bags Market Trend Analysis:

The shift towards the use of non-PVC materials.

- One of the major trends observed in the market for the empty IV bags are indications towards the application of the non-PVC material. As there are heightened concerns as to the adverse effects of plastics on the environment, and the health effects resulting from PVC, the Frond users are finding new materials like the polyolefin and ethylene vinyl acetate (EVA) being used in the IV bags manufacturing. Such a trend stands in tune with the general direction to embrace environmentally friendly and more secure medical products for use by the medical personnel and patients.

- There is also increased localization of IV bags with other health care requirements now being incorporated in the bags. Secure closure of the bag contents is important to healthcare facilities and its patients, there are new opportunities such as pre-filled & color-coded bags needed by clinics & hospitals for improving patient’s safety on medication administration. This customization contributes to minimizing medication errors and enhancing patient outcomes fuelling development in the empty IV bags market.

The increasing investments in healthcare infrastructure.

- The global empty IV bags market has a great potential for growth in the emerging markets. As the stakes are being raised to further enhance the healthcare facilities and because of the awareness concerning the contemporary medical procedures, the Asia-Pacific and Latin America have recorded a growing demand for healthcare items such as IV bags. This is due to increasing population, spending on health care and awareness and demand for improving standards of healthcare, making it a golden opportunity for manufacturers.

- In addition, demand for the empty IV bags has opportunities to grow significantly with the emergence of home health care services. As the patient drifts towards home treatment, the IV oil bags must be movable and easy to use. This change not only makes patients happier but also decreases the hospitals’ readmission rates; therefore, there is demand for the new IV bag designs specially for home application.

Empty IV Bags Market Segment Analysis:

Empty IV Bags Market Segmented on the basis of type, application, end user, and region.

By Product Type, PVC IV Bags segment is expected to dominate the market during the forecast period

- The empty IV bags market is segmented into two primary product types: PVC infusion bags and non-PVC infusion bags. PVC IV bags have been popular in healthcare since they are very flexible, durable and relatively cheaper compared to other material. But with rising awareness about the safety issues linked to phthalate-flexible PVC materials included in bags, there is a trend towards non-PVC IV bags. Conventional PVC free IV bags are manufactured from other materials such as polyolefin or ethylene vinyl acetate (EVA) materials which are safer and ecofriendly. This shift is due to the promotion of better patient safety as well as the call for more environmentally friendly and long-lasting medical products thus the need to have non-PVC materials in different health care facilities.

By Capacity, less than 250 ml segment expected to held the largest share

- The empty IV bags market is categorized by capacity into three segments: It includes less than 250 ml, 250 ml to 500 ml and more than 500 ml IV bags with the capacity of less than 250 ml is usually used for particular purpose like to give medicine or fluid to children and those whom the health practitioner wants a brief infusion. The working range of bottle sizes is from 250 ml to 500 ml with the 250 to 500 ml range being favoured in many wards and clinics due to the reason that it is media a good compromise between quantity and practicality. On the other hand, For example IV bags with carrying capacity over 500 ml are used in large volume infusion cases like during surgeries, Icu, or in cases of fluid bolus. This segmentation helps the medical organisation to identify and choose the most appropriate size of IV bag for the care requirements and patient need in order to achieve sufficient and safe fluid delivery.

Empty IV Bags Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the largest market for empty IV bags, mainly because of the better healthcare facilities and high per capita health care spending. The United States and Canada hold a rather large share on the market owning to a high number of hospitals and other healthcare establishments stating the need for IV bags in a vast amount of medical procedures. The existence of significant market participants coupled with highly effective regulatory norms also adds to the demand of this region in the global market.

- Also, the increased focus on patient safety and care quality in North American region has increased the development of IV bag innovation. Manufacturers in this region have remained engaged in the development of research in order to come up with safer and more efficient IV delivery systems. Therefore, North America is anticipated to continue its dominance in the empty IV bags market due to growing technologies and focus on the patient side in terms of a healthcare facility.

Active Key Players in the Empty IV Bags Market

- Amcor plc (Australia)

- B. Braun Melsungen AG (Germany)

- Baxter International Inc. (United States)

- Cardinal Health, Inc. (United States)

- Fresenius Kabi AG (Germany)

- McKesson Corporation (United States)

- Medline Industries, Inc. (United States)

- Sippex (United States)

- Smith’s Medical (United Kingdom)

- Terumo Corporation (Japan)

- Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Empty IV Bags Market by Product Type

4.1 Empty IV Bags Market Snapshot and Growth Engine

4.2 Empty IV Bags Market Overview

4.3 PVC IV Bags

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 PVC IV Bags: Geographic Segmentation Analysis

4.4 Non-PVC IV Bags

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Non-PVC IV Bags: Geographic Segmentation Analysis

Chapter 5: Empty IV Bags Market by Capacity

5.1 Empty IV Bags Market Snapshot and Growth Engine

5.2 Empty IV Bags Market Overview

5.3 Less than 250 ml

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Less than 250 ml: Geographic Segmentation Analysis

5.4 250 ml to 500 ml

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 250 ml to 500 ml: Geographic Segmentation Analysis

5.5 more than 500 ml

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 more than 500 ml: Geographic Segmentation Analysis

Chapter 6: Empty IV Bags Market by Material Type

6.1 Empty IV Bags Market Snapshot and Growth Engine

6.2 Empty IV Bags Market Overview

6.3 Polyvinyl Chloride (PVC)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Polyvinyl Chloride (PVC): Geographic Segmentation Analysis

6.4 Polyolefin

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Polyolefin: Geographic Segmentation Analysis

6.5 Other Materials

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Other Materials: Geographic Segmentation Analysis

Chapter 7: Empty IV Bags Market by End User

7.1 Empty IV Bags Market Snapshot and Growth Engine

7.2 Empty IV Bags Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Ambulatory Surgical Centers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

7.5 Home Healthcare

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Home Healthcare: Geographic Segmentation Analysis

7.6 Other End-Users

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Other End-Users: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Empty IV Bags Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BAXTER INTERNATIONAL INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 B. BRAUN MELSUNGEN AG (GERMANY)

8.4 FRESENIUS KABI AG (GERMANY)

8.5 TERUMO CORPORATION (JAPAN)

8.6 CARDINAL HEALTH INC. (UNITED STATES)

8.7 MCKESSON CORPORATION (UNITED STATES)

8.8 SMITHS MEDICAL (UNITED KINGDOM)

8.9 AMCOR PLC (AUSTRALIA)

8.10 SIPPEX (UNITED STATES)

8.11 MEDLINE INDUSTRIES INC. (UNITED STATES)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Empty IV Bags Market By Region

9.1 Overview

9.2 . North America Empty IV Bags Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 PVC IV Bags

9.2.4.2 Non-PVC IV Bags

9.2.5 Historic and Forecasted Market Size By Capacity

9.2.5.1 Less than 250 ml

9.2.5.2 250 ml to 500 ml

9.2.5.3 more than 500 ml

9.2.6 Historic and Forecasted Market Size By Material Type

9.2.6.1 Polyvinyl Chloride (PVC)

9.2.6.2 Polyolefin

9.2.6.3 Other Materials

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals

9.2.7.2 Ambulatory Surgical Centers

9.2.7.3 Home Healthcare

9.2.7.4 Other End-Users

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3 . Eastern Europe Empty IV Bags Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 PVC IV Bags

9.3.4.2 Non-PVC IV Bags

9.3.5 Historic and Forecasted Market Size By Capacity

9.3.5.1 Less than 250 ml

9.3.5.2 250 ml to 500 ml

9.3.5.3 more than 500 ml

9.3.6 Historic and Forecasted Market Size By Material Type

9.3.6.1 Polyvinyl Chloride (PVC)

9.3.6.2 Polyolefin

9.3.6.3 Other Materials

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals

9.3.7.2 Ambulatory Surgical Centers

9.3.7.3 Home Healthcare

9.3.7.4 Other End-Users

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4 . Western Europe Empty IV Bags Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 PVC IV Bags

9.4.4.2 Non-PVC IV Bags

9.4.5 Historic and Forecasted Market Size By Capacity

9.4.5.1 Less than 250 ml

9.4.5.2 250 ml to 500 ml

9.4.5.3 more than 500 ml

9.4.6 Historic and Forecasted Market Size By Material Type

9.4.6.1 Polyvinyl Chloride (PVC)

9.4.6.2 Polyolefin

9.4.6.3 Other Materials

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals

9.4.7.2 Ambulatory Surgical Centers

9.4.7.3 Home Healthcare

9.4.7.4 Other End-Users

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5 . Asia Pacific Empty IV Bags Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 PVC IV Bags

9.5.4.2 Non-PVC IV Bags

9.5.5 Historic and Forecasted Market Size By Capacity

9.5.5.1 Less than 250 ml

9.5.5.2 250 ml to 500 ml

9.5.5.3 more than 500 ml

9.5.6 Historic and Forecasted Market Size By Material Type

9.5.6.1 Polyvinyl Chloride (PVC)

9.5.6.2 Polyolefin

9.5.6.3 Other Materials

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals

9.5.7.2 Ambulatory Surgical Centers

9.5.7.3 Home Healthcare

9.5.7.4 Other End-Users

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6 . Middle East & Africa Empty IV Bags Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 PVC IV Bags

9.6.4.2 Non-PVC IV Bags

9.6.5 Historic and Forecasted Market Size By Capacity

9.6.5.1 Less than 250 ml

9.6.5.2 250 ml to 500 ml

9.6.5.3 more than 500 ml

9.6.6 Historic and Forecasted Market Size By Material Type

9.6.6.1 Polyvinyl Chloride (PVC)

9.6.6.2 Polyolefin

9.6.6.3 Other Materials

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals

9.6.7.2 Ambulatory Surgical Centers

9.6.7.3 Home Healthcare

9.6.7.4 Other End-Users

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7 . South America Empty IV Bags Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 PVC IV Bags

9.7.4.2 Non-PVC IV Bags

9.7.5 Historic and Forecasted Market Size By Capacity

9.7.5.1 Less than 250 ml

9.7.5.2 250 ml to 500 ml

9.7.5.3 more than 500 ml

9.7.6 Historic and Forecasted Market Size By Material Type

9.7.6.1 Polyvinyl Chloride (PVC)

9.7.6.2 Polyolefin

9.7.6.3 Other Materials

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals

9.7.7.2 Ambulatory Surgical Centers

9.7.7.3 Home Healthcare

9.7.7.4 Other End-Users

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Empty IV Bags Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.92 Billion |

|

Forecast Period 2024-32 CAGR: |

8.70 % |

Market Size in 2032: |

USD 10.42 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Capacity |

|

||

|

By Material Type |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Empty IV Bags Market research report is 2024-2032.

Amcor plc (Australia), B. Braun Melsungen AG (Germany), Baxter International Inc. (United States), Cardinal Health, Inc. (United States), Fresenius Kabi AG (Germany), McKesson Corporation (United States), Medline Industries, Inc. (United States), Sippex (United States), Smith’s Medical (United Kingdom), Terumo Corporation (Japan), Other Active Players.

The Empty IV Bags Market is segmented into by Product Type (PVC IV Bags, Non-PVC IV Bags), By Capacity (Less than 250 ml, 250 ml to 500 ml, more than 500 ml), Material Type (Polyvinyl Chloride (PVC), Polyolefin, Other Materials), End User (Hospitals, Ambulatory Surgical Centers, Home Healthcare, Other End-Users). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The empty iv bags is a segment of the health care that manufactures and sells IV bags which do not contain any contents and can be used for delivering fluids, food and medications to the patients. They are avails in a variety of materials, and dimensions and arrangement to suit the different medical requirements for hospitals, clinics and home care facilities. In addition, increasing pressure on healthcare systems to deliver affordable and effective care, along with the innovation of new health care product solutions, also act as an opportunity for this market. y content, primarily used for administering fluids, medications, and nutrients to patients. These bags come in various materials, sizes, and configurations, catering to diverse medical needs across hospitals, clinics, and home healthcare settings. The rising demand for efficient patient care and advancements in medical technology are key factors driving the growth of this market.

Empty IV Bags Market Size Was Valued at USD 4.92 Billion in 2023, and is Projected to Reach USD 10.42 Billion by 2032, Growing at a CAGR of 8.70% From 2024-2032.