Accelerometer Market Synopsis

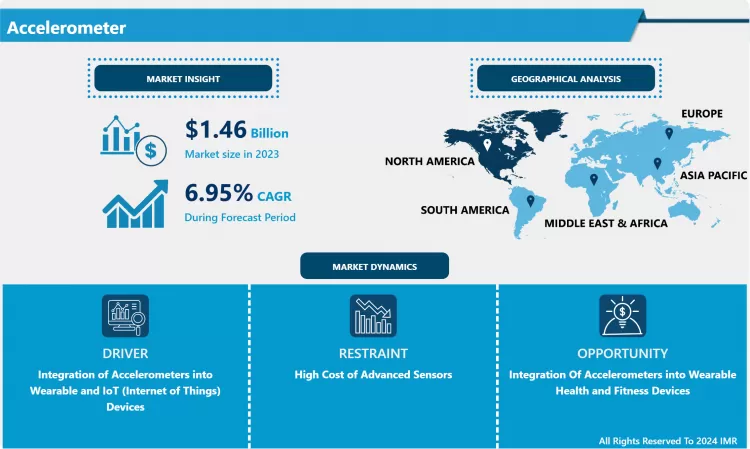

Accelerometer Market Size Was Valued at USD 1.46 Billion in 2023 and is Projected to Reach USD 2.67 Billion by 2032, Growing at a CAGR of 6.95% From 2024-2032.

An accelerometer is a device that measures the acceleration of an object relative to an observer in free fall. Accelerometers are inertial sensors that measure changes in velocity over time, such as bumps, vibrations, and sharp changes in velocity. They can also detect the frequency and intensity of human movement.

- Progress in MEMS technology has resulted in the creation of compact and inexpensive accelerometers that enhance sensitivity, accuracy, and reliability. Consequently, accelerometers are currently utilized in a vast array of applications. The increasing desire for consumer electronics such as smartphones, tablets, and wearables has intensified the requirement for accelerometers in devices for functions like screen rotation, gaming, and health tracking. The accelerometer market growth is driven by an increase in emerging markets, fueled by the uptake of technology and consumer electronics.

- Accelerometers are used in automotive technology for ADAS functions such as stability control and navigation within the vehicle. In the field of industrial automation, they are utilized for predictive maintenance through the monitoring of machinery vibrations and for process monitoring in order to enhance industrial processes. Their ability to adapt and be used in various ways helps to boost the development of these sectors. Accelerometers play a crucial role in navigation and control in aerospace and defence, as well as in medical devices for patient monitoring and wearable health monitors for tracking physical activity and health metrics.

- Accelerometers are used in smart home devices for detecting motion, controlling gestures, and automating tasks, and also in a variety of connected devices across different industries. The rise in consumer interest for interactive and user-friendly features has resulted in the utilization of accelerometers for motion sensing and gesture recognition. The increasing emphasis on staying healthy and fit has also increased the popularity of accelerometers in wearable gadgets. Furthermore, the cost of accelerometers has decreased due to economies of scale and technological improvements, making them available for a broader range of uses.

Accelerometer Market Trend Analysis

Integration of Accelerometers into Wearable and IoT (Internet of Things) Devices

- Accelerometers play a pivotal role in wearable devices, transforming how we monitor and manage our health and fitness. Embedded in fitness trackers, smartwatches, and health monitoring devices, these tiny sensors measure movement in various directions, enabling wearables to accurately track physical activities like walking, running, cycling, and even sleep patterns. For fitness enthusiasts and health-conscious individuals, this means that every step taken, every calorie burned, and overall activity levels can be monitored in real time, offering a personalized approach to maintaining and improving physical well-being.

- Beyond fitness, accelerometers are also instrumental in health monitoring applications, making wearables valuable tools for a broader audience, including the elderly and those managing chronic conditions. These sensors can detect falls, an essential feature for elderly care, where timely alerts can prevent serious injuries. They also assist in tracking rehabilitation progress, providing insights that can guide recovery.

- The integration of accelerometers into wearables and IoT devices brings several key advantages that enhance both functionality and user experience. One of the standout benefits is miniaturization and power efficiency. Thanks to advances in accelerometer technology, these sensors have become smaller and more power-efficient, making them seamlessly fit into compact wearables and IoT devices without sacrificing performance. This means that devices can be designed to be more sophisticated yet unobtrusive, leading to greater user comfort and higher adoption rates.

Integration of Accelerometers into Wearable Health and Fitness Devices

- The integration of accelerometers into wearable health and fitness devices presents a wealth of opportunities by significantly enhancing their functionality and expanding their applications. These sensors enable wearables to accurately track a range of physical activities such as walking, running, and cycling by measuring acceleration in various directions, providing users with precise data on steps taken, distance covered, and calories burned. Beyond fitness tracking, accelerometers contribute to advanced health monitoring features, including fall detection and vital sign monitoring, which are invaluable for elderly care and chronic disease management.

- Additionally, accelerometers enable a highly personalized user experience. They allow devices to analyze individual movement patterns and provide tailored workout recommendations, real-time feedback on exercise form, and insights into behavioral patterns like sedentary periods. This customization helps users optimize their fitness routines and improve their overall health. The integration also opens new market applications, such as preventive healthcare, where wearables can help in early diagnosis and chronic disease management, and sports performance enhancement, where detailed analysis of athletes' movements can lead to improved training outcomes.

- The connectivity with IoT technology allows for the development of interconnected ecosystems that enhance the functionality of wearables. This integration also presents new business opportunities, such as subscription services for advanced features, partnerships with healthcare providers, and data monetization strategies. Overall, the integration of accelerometers into wearables is driving innovation, offering new possibilities for health and fitness monitoring, and expanding the market's potential.

Accelerometer Market Segment Analysis:

- Accelerometer Market Segmented on the basis of Type, Application, Technology, End user.

By Type, CD Response Segment is Expected to Dominate the Market During the Forecast Period

- CD response accelerometers are used in various applications, such as static measurements and low-frequency applications. They offer enhanced sensor performance with increased sensitivity and consistent output, making them suitable for tasks that demand accurate detection of slight movements or changes, as well as tasks where dependability is essential. Accelerometers in consumer electronics such as smartphones and tablets detect device orientation and tilt, enhancing user experience. These accelerometers in wearables monitor posture and orientation for health and fitness tracking purposes.

- CD response accelerometers are essential in automotive settings like vehicle dynamics and stability control, identifying and adjusting for vehicle tilt and acceleration. Also, they are utilized in GPS systems to improve the driving journey. In industrial and aerospace environments, these sensors track machine vibrations and structural integrity in buildings and planes. Progress in MEMS technology has shrunk, made more affordable, and increased the reliability of CD response accelerometers, with their versatility and capabilities expanding through integration with other sensors.

- CD response accelerometers are favoured for mass-market applications such as consumer electronics because of their affordability resulting from lower production expenses. The performance characteristics of CD response accelerometers meet the industries' growing need for greater precision and reliability. These accelerometers have been created specifically.

By End-user, Consumer Electronics Segment Held the Largest Share In 2023

- Accelerometers found in smartphones and tablets improve user experience by allowing features such as screen rotation and games based on motion. They are additionally utilized for navigation as well as augmented reality purposes. Accelerometers in fitness trackers and smartwatches in wearable technology monitor physical activities and offer health-related information, allowing for heart rate monitoring and GPS tracking. Increasing market penetration is a result of the growing popularity of smart devices and the incorporation of accelerometers in consumer electronics

- Accelerometers improve gaming and VR by creating immersive experiences through movement detection. They play a crucial role in creating authentic gaming encounters and are vital for motion-controlled gaming. The rise of smart devices, such as IoT gadgets, comes with the integration of accelerometers for detecting motion. There is a high demand for accelerometers in portable and wearable electronics because of their small size and efficient design.

- Innovations in MEMS technology have led to accelerometers becoming smaller, more efficient, and cost-effective, broadening their application in consumer electronics. Enhanced sensitivity and precision have expanded their range of uses. Consumer preferences for health and wellness are driving the need for fitness devices equipped with accelerometers. The demand for accelerometers in consumer electronics is fuelled by customizable functions such as gesture controls.

Accelerometer Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America dominates the accelerometer market due to several key factors that drive its leadership in the sector. The region’s dominance can be attributed to its advanced technological infrastructure, high adoption rates of consumer electronics, and substantial investment in research and development. North America, particularly the United States, is home to numerous leading technology companies and research institutions that continually push the boundaries of accelerometer technology, contributing to significant advancements and innovations.

- The robust consumer electronics market in North America supports the widespread use of accelerometers in various devices such as smartphones, wearables, and smart home systems. The high consumer demand for advanced features in these devices, including fitness tracking and motion sensing, drives the need for sophisticated accelerometer technology. Furthermore, North American companies are at the forefront of integrating accelerometers with emerging technologies like artificial intelligence (AI) and the Internet of Things (IoT), enhancing the functionality and application of these sensors across different industries.

- In addition, substantial investments in automotive and aerospace sectors in North America contribute to the market's growth. Accelerometers are critical components in automotive systems for stability control, collision detection, and advanced driver assistance systems (ADAS). The automotive industry's focus on innovation and safety features fuels the demand for advanced accelerometer technologies. Similarly, the aerospace sector's requirements for precise motion sensing and stability control further boost the market.

Accelerometer Market Active Players

- Analog Devices, Inc. (USA)

- Bosch Sensortec GmbH (Germany)

- STMicroelectronics N.V. (Switzerland)

- Texas Instruments Incorporated (USA)

- InvenSense, Inc. (USA)

- Murata Manufacturing Co., Ltd. (Japan)

- Honeywell International Inc. (USA)

- NXP Semiconductors N.V. (Netherlands)

- Robert Bosch GmbH (Germany)

- Qualcomm Incorporated (USA)

- Omron Corporation (Japan)

- Kionix, Inc. (USA)

- MEMSIC, Inc. (USA)

- Broadcom Inc. (USA)

- Analog Devices, Inc. (USA)

- Microchip Technology Inc. (USA)

- TDK Corporation (Japan)

- Ams AG (Austria)

- Cree, Inc. (USA)

- Sensata Technologies Holding plc (USA)

- Qualcomm Technologies, Inc. (USA)

- L3 Technologies, Inc. (USA)

- Cypress Semiconductor Corporation (USA)

- Vishay Intertechnology, Inc. (USA)

- Micro-Electro-Mechanical Systems (MEMS) Inc. (USA), and other Active Players.

Key Industry Developments in the Accelerometer Market:

- In January 2024, STMicroelectronics announced the debut of its new ultra-low-power MEMS accelerometer with a focus on IoT and wearables. This innovative solution uses much less power while maintaining good accuracy, meeting the growing demand for energy-efficient sensors in portable devices.

- In January 2024, Bosch Sensortec unveiled a new AI-enabled accelerometer with machine-learning capabilities integrated directly into the sensor. This work intends to improve motion detection accuracy and allow for more complex gesture recognition in smartphones and wearables.

- In January 2023, STMicroelectronics brought a 32-bit kick to cost-sensitive 8-bit applications with STM32C0 series microcontrollers. This integrated circuit combined with an accelerometer and gyroscope works as a 3D axis accelerometer.

INTRODUCTION

RESEARCH OBJECTIVES

RESEARCH METHODOLOGY

RESEARCH PROCESS

SCOPE AND COVERAGE

Market Definition

Key Questions Answered

MARKET SEGMENTATION

EXECUTIVE SUMMARY

MARKET OVERVIEW

GROWTH OPPORTUNITIES BY SEGMENT

MARKET LANDSCAPE

PORTER’S FIVE FORCES ANALYSIS

Bargaining Power of Supplier

Threat Of New Entrants

Threat Of Substitutes

Competitive Rivalry

Bargaining Power Among Buyers

INDUSTRY VALUE CHAIN ANALYSIS

MARKET DYNAMICS

Drivers

Restraints

Opportunities

Challenges

MARKET TREND ANALYSIS

REGULATORY LANDSCAPE

PESTLE ANALYSIS

PRICE TREND ANALYSIS

PATENT ANALYSIS

TECHNOLOGY EVALUATION

MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

Geopolitical Market Disruptions

Supply Chain Disruptions

Instability in Emerging Markets

ECOSYSTEM

ACCELEROMETER MARKET BY TYPE (2017-2032)

ACCELEROMETER MARKET SNAPSHOT AND GROWTH ENGINE

MARKET OVERVIEW

AC RESPONSE

Introduction And Market Overview

Historic And Forecasted Market Size in Value (2017-2032F)

Historic And Forecasted Market Size in Volume (2017-2032F)

Key Market Trends, Growth Factors and Opportunities

Geographic Segmentation Analysis

CD RESPONSE

ACCELEROMETER MARKET BY APPLICATION (2017-2032)

ACCELEROMETER MARKET SNAPSHOT AND GROWTH ENGINE

MARKET OVERVIEW

CONSUMER ELECTRONICS

Introduction And Market Overview

Historic And Forecasted Market Size in Value (2017-2032F)

Historic And Forecasted Market Size in Volume (2017-2032F)

Key Market Trends, Growth Factors And Opportunities

Geographic Segmentation Analysis

AUTOMOTIVE

AEROSPACE & DEFENSE

INDUSTRIAL

HEALTHCARE

ACCELEROMETER MARKET BY TECHNOLOGY (2017-2032)

ACCELEROMETER MARKET SNAPSHOT AND GROWTH ENGINE

MARKET OVERVIEW

ANALOG ACCELEROMETERS

Introduction And Market Overview

Historic And Forecasted Market Size in Value (2017-2032F)

Historic And Forecasted Market Size in Volume (2017-2032F)

Key Market Trends, Growth Factors And Opportunities

Geographic Segmentation Analysis

DIGITAL ACCELEROMETERS

ACCELEROMETER MARKET BY END USER (2017-2032)

ACCELEROMETER MARKET SNAPSHOT AND GROWTH ENGINE

MARKET OVERVIEW

AUTOMOTIVE INDUSTRY

Introduction And Market Overview

Historic And Forecasted Market Size in Value (2017-2032F)

Historic And Forecasted Market Size in Volume (2017-2032F)

Key Market Trends, Growth Factors And Opportunities

Geographic Segmentation Analysis

CONSUMER ELECTRONICS

INDUSTRIAL SECTOR

AEROSPACE AND DEFENSE

HEALTHCARE

COMPANY PROFILES AND COMPETITIVE ANALYSIS

COMPETITIVE LANDSCAPE

Competitive Benchmarking

Accelerometer Market Share By Manufacturer (2023)

Industry BCG Matrix

Heat Map Analysis

Mergers & Acquisitions

ANALOG DEVICES, INC. (USA)

Company Overview

Key Executives

Company Snapshot

Role of the Company in the Market

Sustainability and Social Responsibility

Operating Business Segments

Product Portfolio

Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

Key Strategic Moves And Recent Developments

SWOT Analysis

BOSCH SENSORTEC GMBH (GERMANY)

STMICROELECTRONICS N.V. (SWITZERLAND)

TEXAS INSTRUMENTS INCORPORATED (USA)

INVENSENSE, INC. (USA)

MURATA MANUFACTURING CO., LTD. (JAPAN)

HONEYWELL INTERNATIONAL INC. (USA)

NXP SEMICONDUCTORS N.V. (NETHERLANDS)

ROBERT BOSCH GMBH (GERMANY)

QUALCOMM INCORPORATED (USA)

OMRON CORPORATION (JAPAN)

KIONIX, INC. (USA)

MEMSIC, INC. (USA)

BROADCOM INC. (USA)

ANALOG DEVICES, INC. (USA)

MICROCHIP TECHNOLOGY INC. (USA)

TDK CORPORATION (JAPAN)

AMS AG (AUSTRIA)

CREE, INC. (USA)

SENSATA TECHNOLOGIES HOLDING PLC (USA)

QUALCOMM TECHNOLOGIES, INC. (USA)

L3 TECHNOLOGIES, INC. (USA)

CYPRESS SEMICONDUCTOR CORPORATION (USA)

VISHAY INTERTECHNOLOGY, INC. (USA)

MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS) INC. (USA)

GLOBAL ACCELEROMETER MARKET BY REGION

OVERVIEW

NORTH AMERICA

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Type

Historic And Forecasted Market Size By Application

Historic And Forecasted Market Size By Technology

Historic And Forecasted Market Size By End user

Historic And Forecasted Market Size By Segment5

Historic And Forecasted Market Size By Segment6

Historic And Forecasted Market Size By Country

USA

Canada

Mexico

EASTERN EUROPE

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Segments

Historic And Forecasted Market Size By Country

Russia

Bulgaria

The Czech Republic

Hungary

Poland

Romania

Rest Of Eastern Europe

WESTERN EUROPE

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Segments

Historic And Forecasted Market Size By Country

Germany

United Kingdom

France

The Netherlands

Italy

Spain

Rest Of Western Europe

ASIA PACIFIC

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Segments

Historic And Forecasted Market Size By Country

China

India

Japan

South Korea

Malaysia

Thailand

Vietnam

The Philippines

Australia

New-Zealand

Rest Of APAC

MIDDLE EAST & AFRICA

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Segments

Historic And Forecasted Market Size By Country

Turkey

Bahrain

Kuwait

Saudi Arabia

Qatar

UAE

Israel

South Africa

SOUTH AMERICA

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Segments

Historic And Forecasted Market Size By Country

Brazil

Argentina

Rest of South America

INVESTMENT ANALYSIS

ANALYST VIEWPOINT AND CONCLUSION

Recommendations and Concluding Analysis

Potential Market Strategies

Thailand

Vietnam

The Philippines

Australia

New-Zealand

Rest Of APAC

MIDDLE EAST & AFRICA

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Segments

Historic And Forecasted Market Size By Country

Turkey

Bahrain

Kuwait

Saudi Arabia

Qatar

UAE

Israel

South Africa

SOUTH AMERICA

Key Market Trends, Growth Factors And Opportunities

Key Manufacturers

Historic And Forecasted Market Size By Segments

Historic And Forecasted Market Size By Country

Brazil

Argentina

Rest of South America

INVESTMENT ANALYSIS

ANALYST VIEWPOINT AND CONCLUSION

Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Accelerometer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.95% |

Market Size in 2032: |

USD 2.67 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Accelerometer Market research report is 2024-2032.

Analog Devices, Inc. (USA), Bosch Sensortec GmbH (Germany), STMicroelectronics N.V. (Switzerland), Texas Instruments Incorporated (USA), InvenSense, Inc. (USA), Murata Manufacturing Co., Ltd. (Japan), Honeywell International Inc. (USA), NXP Semiconductors N.V. (Netherlands), Robert Bosch GmbH (Germany), Qualcomm Incorporated (USA), Omron Corporation (Japan), Kionix, Inc. (USA), MEMSIC, Inc. (USA), Broadcom Inc. (USA), Analog Devices, Inc. (USA), Microchip Technology Inc. (USA), TDK Corporation (Japan), Ams AG (Austria), Cree, Inc. (USA), Sensata Technologies Holding plc (USA), Qualcomm Technologies, Inc. (USA), L3 Technologies, Inc. (USA), Cypress Semiconductor Corporation (USA), Vishay Intertechnology, Inc. (USA), Micro-Electro-Mechanical Systems (MEMS) Inc. (USA)and Other Active Players.

The Accelerometer Market is segmented into Type, Application, Technology, End user, Segment5, Segment6, and region. By Type, the market is categorized into AC Response, CD Response. By Application, the market is categorized into Consumer Electronics, Automotive, Aerospace & Defense, Industrial, Healthcare. By Technology, the market is categorized into Analog Accelerometers, Digital Accelerometers. By End user, the market is categorized into Automotive Industry, Consumer Electronics, Industrial Sector, Aerospace and Defense, Healthcare. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An accelerometer is a device that measures the acceleration of an object relative to an observer in free fall. Accelerometers are inertial sensors that measure changes in velocity over time, such as bumps, vibrations, and sharp changes in velocity. They can also detect frequency and intensity of human movement.

Accelerometer Market Size Was Valued at USD 1.46 Billion in 2023, and is Projected to Reach USD 2.67 Billion by 2032, Growing at a CAGR of 6.95% From 2024-2032.